LIBRARYライブラリー

【特集】新型コロナ関連(COVID-19) THAILAND 国・地域情報

【COVID-19】 Special Tax Incentive for Employment Stability in SMEs:Additional 2 Times Deduction of Wage Expenses

2020.08.21

Special Tax Incentive for Employment Stability in SMEs

Additional 2 Times Deduction of Wage Expenses

– Issue No. 708 –

|

This has been already publicly announced, and we are sure that you are very much interested. However, some points are not enough clear to be started applying. Further guidelines and conditions will be defined in Notification of Director General (NDG). |

1.OVERVIEW

300% of wage expenses from April to July (Normal 100% one + Special 200% one) will be counted as expense in tax calculation

2.APPLICABLE REQUIREMENTS

1)SMEs

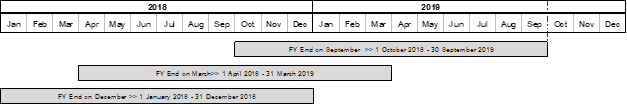

Annual sales in fiscal year ended before 30th September 2019 shall not exceed 500 million baht and has no more than 200 employees

2)Monthly Wage

Must maintain employment of insured employees covered under social security and wages must not be more than 15,000 baht/person/month

(Not inclusive of variable allowance such as overtime pay, bonuses or other benefits. It is still not clear if only employees who get wages under 15,000 baht is subject to the tax relief or not. It will be clarified in NDG)

3)Maintaining Employment

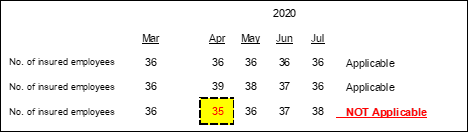

Total number of insured employees covered under social security from 1st April 2020 to 31st July 2020 must not be less than the total number of insured employees as of the last day of March 2020

(This restriction may be relaxed if the number was decreased by reasonable grounds as planned to be specified in NDG)

3.PROCEDURE

Register at www.rd.go.th

Applicable Period:

<Start Date> From the date the system becomes available

(At present, TRD has not opened for the registration yet)

<Last Applicable Date> Within 150 days from the end of FY of the year of exercise

Reference: Revenue Department News No. 40/2020, Date: 24th June 2020

Royal Decree issued under the Revenue Code on Tax Exemption (Issue No. 708)

Contact Us

please fill in this form.